Understanding Market HeadlinesWhat Interest Rates, Rents, and Affordability Data Actually Shows

First home buyers are often exposed to a high volume of market commentary, particularly during periods of changing interest rates. Headlines may focus on price movements, borrowing conditions, or rental pressures, which can feel conflicting without context. Market data helps explain how these factors intersect rather than operate independently.

Interest rates in Australia are set by the Reserve Bank of Australia and influence borrowing costs offered by lenders. Changes in interest rates can affect borrowing capacity and buyer activity, but they do not impact all markets or buyers in the same way.

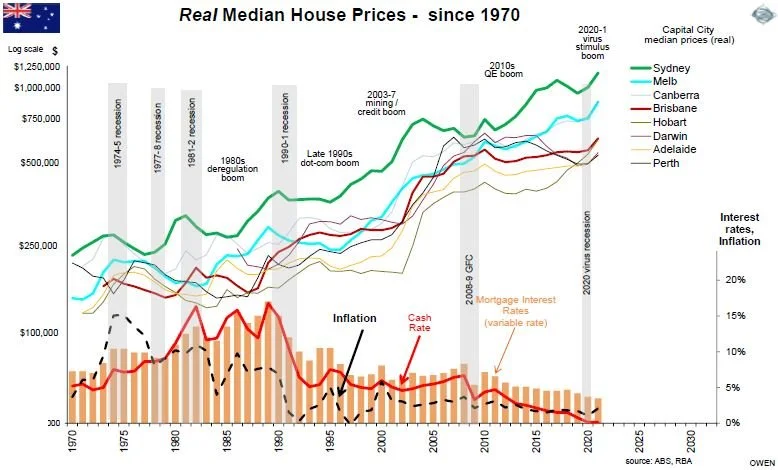

Long term data from the Australian Bureau of Statistics and CoreLogic shows that Australian property prices have increased over extended periods despite multiple interest rate changes. While higher rates have historically slowed price growth, outcomes have varied significantly by location and property type.

Rental market data from SQM Research shows that rental demand has remained strong across many Australian cities, with vacancy rates below long term averages. This has contributed to rental price growth, particularly in metropolitan areas with limited new housing supply.

For first home buyers, this intersection between interest rates and rental conditions is often visible in affordability discussions. Data from Realestate.com.au and Domain shows that while borrowing conditions influence purchase activity, rental market pressure continues to shape household decisions regardless of interest rate direction.

Licensed financial advisors often note in general commentary that first home buyers review affordability, holding expectations, and long term stability when interpreting market data. This information is general only and does not reflect individual circumstances.

Research from the Property Council of Australia highlights ongoing housing supply constraints as a contributing factor to both rental and ownership market dynamics. Understanding this context can help explain why market conditions may feel complex or contradictory at times.

This article provides general information only and does not constitute financial or investment advice.