Managing a Property Portfolio During Higher Interest Rate Environments What Long Term Data Shows

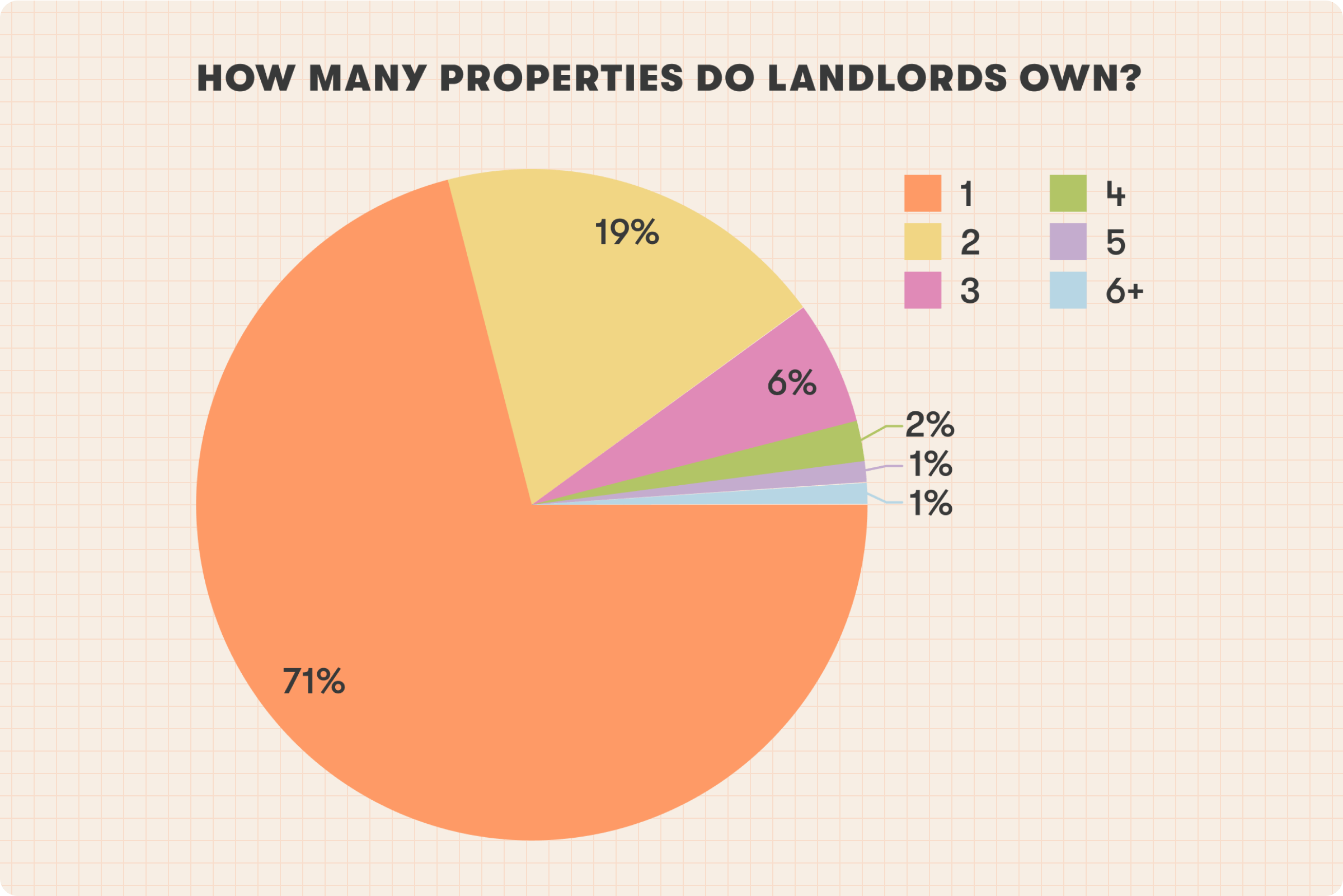

Serial property investors often assess interest rates through the lens of portfolio management rather than individual property performance. When interest rates rise, the focus typically shifts from acquisition speed to structure, sequencing, and sustainability across the entire portfolio.

In Australia, interest rates are set by the Reserve Bank of Australia and influence lending conditions, holding costs, and borrowing capacity. Historical data shows that higher interest rate environments have occurred multiple times over recent decades, with property portfolios adapting rather than uniformly contracting.

Housing data from CoreLogic shows that while price growth often moderates during higher rate periods, property values have continued to trend upward over longer timeframes. This has led many experienced investors to place greater emphasis on portfolio structure during these cycles rather than short term price movement.

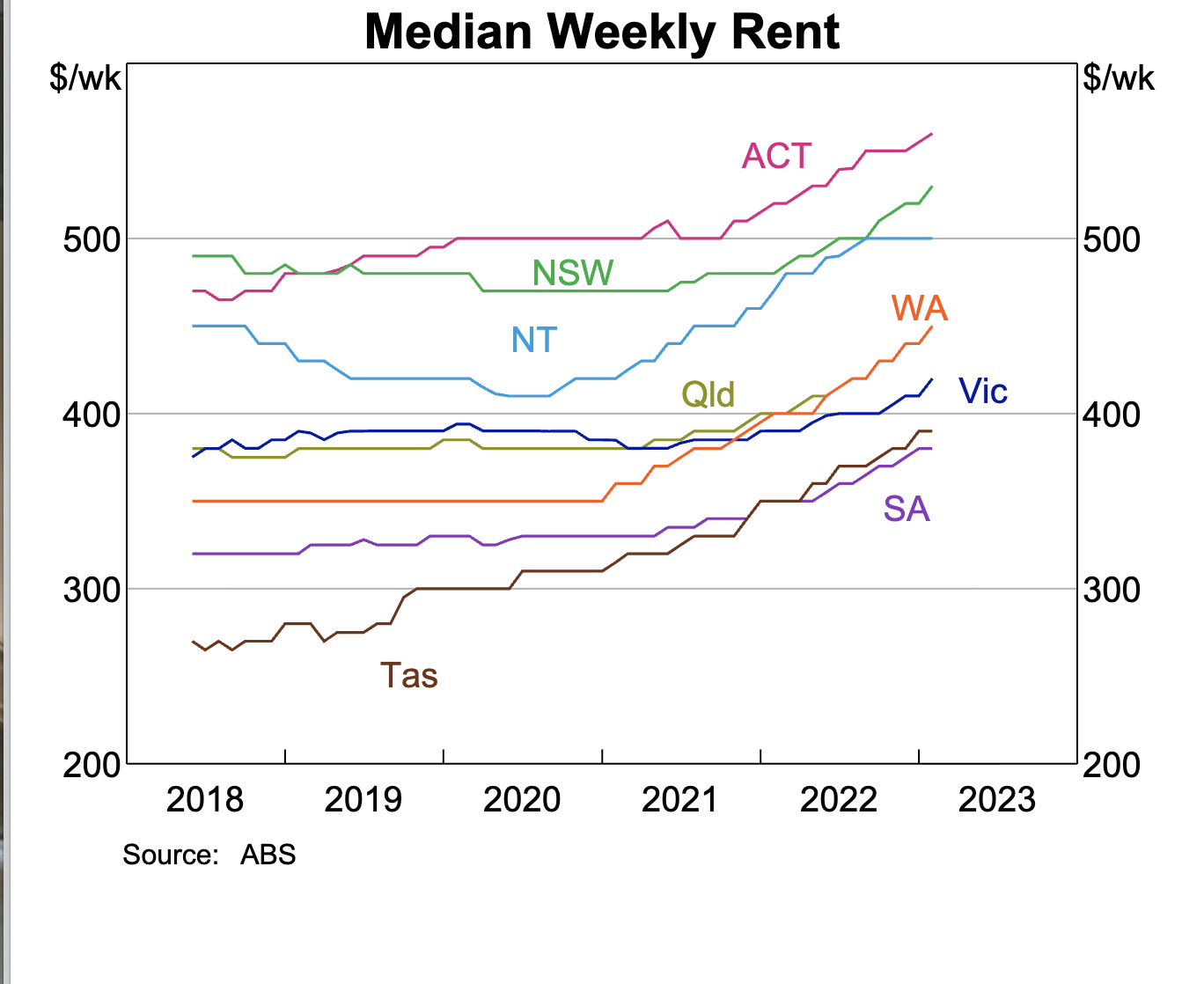

Rental income becomes a more prominent consideration during higher interest rate environments. According to SQM Research, rental markets with low vacancy rates have historically supported income stability even as borrowing costs increase. This has allowed some portfolios to remain serviceable despite tighter credit conditions.

Sequencing also plays a role. Market data from Domain shows that different property types and locations perform differently at various stages of the cycle. Investors managing multiple assets often observe that acquisitions made earlier in a cycle may support later portfolio decisions through accumulated equity or income, although outcomes vary by market.

Licensed financial advisors often note in general commentary that portfolio level considerations during higher rate environments include exposure concentration, loan structure diversity, and the timing of future acquisitions. This information is general in nature and does not consider individual circumstances.

Research from the Property Council of Australia continues to highlight housing supply constraints as a structural factor influencing both rental markets and long term value. For serial investors, this data is often reviewed alongside interest rate settings rather than separately.

This article provides general information based on publicly available Australian market data and does not constitute financial or investment advice.