Interest Rates, Rental Yields and Capital Growth in the Australian Property Market

Property investors often look for clarity around how interest rates influence returns, particularly when comparing rental yields and capital growth. While individual outcomes depend on personal circumstances, historical market data provides useful context for understanding how these factors have behaved over time in Australia.

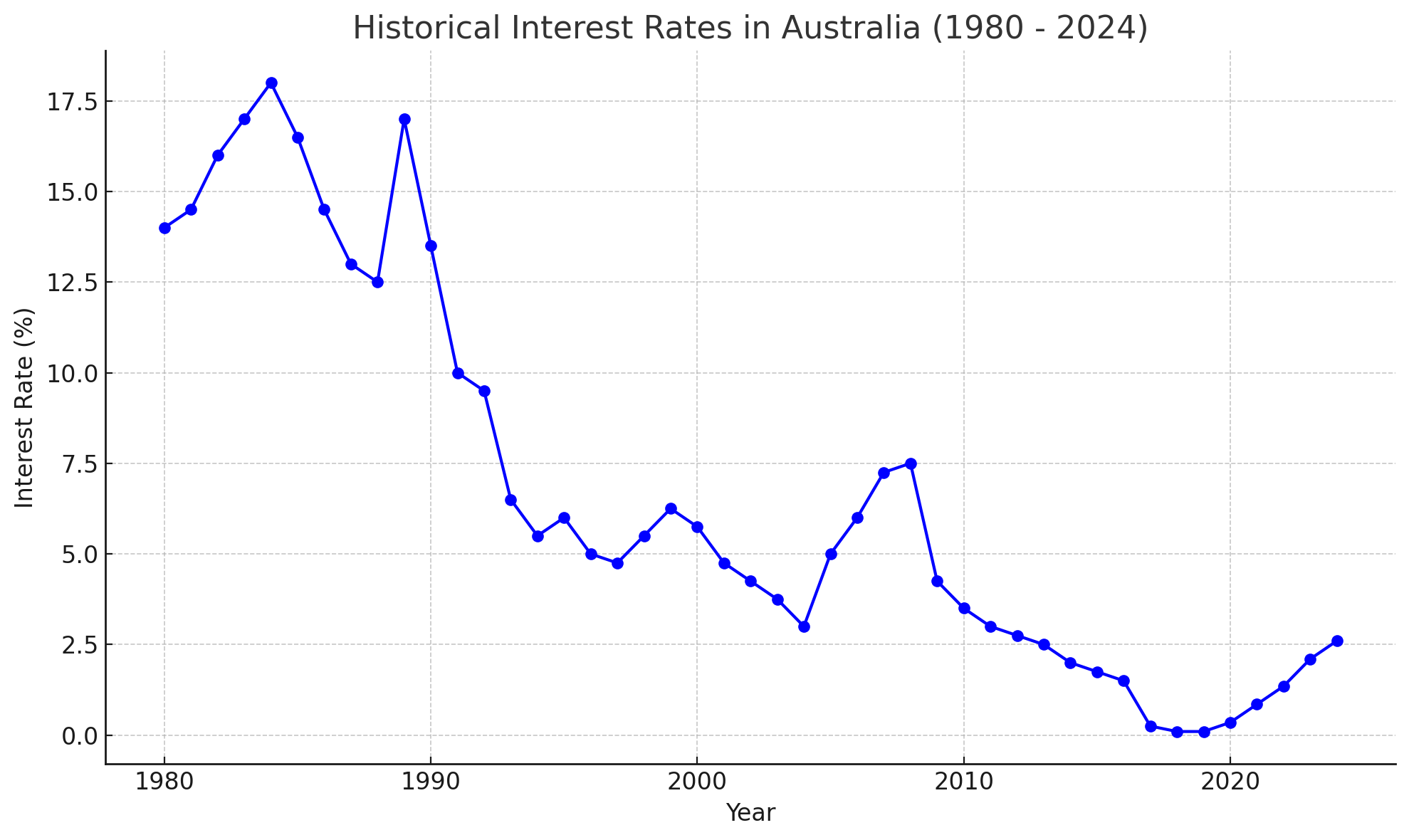

Interest rates influence borrowing costs, investor demand, and household affordability. In Australia, the official cash rate is set by the Reserve Bank of Australia and acts as a benchmark for lending rates offered by banks and financial institutions. Changes to interest rates typically affect property markets through borrowing capacity, investor cash flow, buyer demand, and pricing pressure across different segments.

Long-term data published by the Australian Bureau of Statistics and the Reserve Bank of Australia shows that periods of rising interest rates have generally coincided with slower property price growth, while lower rate environments have supported higher transaction volumes and stronger price momentum. However, these outcomes have not been uniform across all regions or property types.

Capital growth refers to the increase in a property’s value over time. Housing data from CoreLogic and Domain shows that Australian property values have continued to grow across multiple interest rate cycles, although the pace of growth has varied. National housing indices indicate that capital growth has historically been strongest in markets with constrained supply and sustained population demand, even during periods of higher borrowing costs.

Interest rates are one factor among many that influence capital growth. Location, housing supply, infrastructure investment, employment conditions, and population trends also play a significant role in shaping long-term outcomes.

Rental yield measures the annual rental income of a property as a percentage of its value and is commonly used as an indicator of income performance rather than price growth. According to data from SQM Research and the Australian Bureau of Statistics, rental yields often increase when property prices stabilise or grow more slowly. Rental yields can also rise during higher interest rate periods due to rental price pressure, particularly when vacancy rates remain low.

Recent rental market data published by SQM Research shows that vacancy rates across many Australian capital cities remain below long-term averages. This has supported rental price growth and improved gross rental yields in certain locations, although yield performance continues to vary significantly by city, suburb, and dwelling type.

Rental yield and capital growth do not always move together. Market data from CoreLogic and Realestate.com.au indicates that areas with strong capital growth often have lower initial yields, while higher yielding markets may experience slower price growth. Different stages of the property cycle can favour income-focused performance or growth-focused outcomes depending on broader market conditions.

Licensed financial advisors often note, in general commentary, that investors commonly assess interest rate environments by reviewing serviceability under different rate scenarios, the sustainability of rental income, exposure to interest rate changes, and how investment timeframes align with cash flow requirements. This type of information is general in nature and does not account for individual financial situations.

Current market indicators in early 2026, based on publicly available data from the Reserve Bank of Australia, CoreLogic, SQM Research, and Domain, show that interest rates remain a key consideration for borrowing capacity, rental demand continues to exceed supply in many metropolitan areas, and yield and capital growth conditions vary widely by location. Research published by the Property Council of Australia also highlights ongoing housing supply constraints, which continue to influence both rental and ownership markets nationally.

Market data provides context rather than certainty. Investors often use information from the Reserve Bank of Australia, Australian Bureau of Statistics, CoreLogic, SQM Research, Domain, Realestate.com.au, and the Property Council of Australia to understand broader market trends before seeking personalised guidance.

This article is intended to provide general, factual information based on publicly available Australian property and economic data. It does not constitute financial, legal, or investment advice. Individual outcomes depend on personal circumstances, market conditions, and professional guidance.