Property as a Multi Decade Wealth AssetWhat Long Term Ownership Patterns Show

Wealth focused and generational investors often approach property through a multi decade lens rather than short term market cycles. Historical data shows that property ownership has frequently been used as a long term asset for income stability, capital preservation, and intergenerational transition.

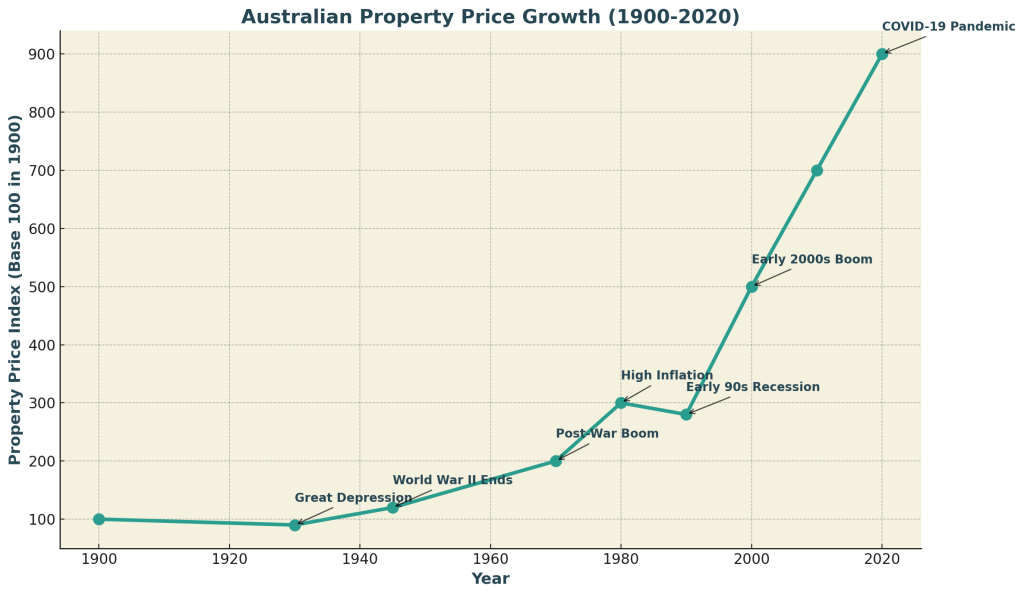

Interest rates, set by the Reserve Bank of Australia, have fluctuated significantly over time. Despite these changes, Australian residential property values have shown long term upward movement according to housing data from CoreLogic.

Long horizon investors often observe that property performance becomes clearer when viewed across decades rather than years. Capital growth has historically been strongest in markets supported by population growth, infrastructure investment, and constrained housing supply, as reflected in data from the Australian Bureau of Statistics and Property Council of Australia.

Rental income has also played a role in sustaining long term ownership. According to SQM Research, rental yields have fluctuated across cycles, often strengthening during periods of undersupply and moderating price growth. This income component has historically supported long term holding strategies.

Discussions around generational wealth often reference long standing family ownership models, including widely discussed examples such as the Rockefeller family, where assets were held, structured, and transitioned over extended timeframes rather than actively traded. These examples are commonly referenced in public commentary and historical literature as illustrations of long term asset stewardship rather than investment timing.

Licensed financial advisors often note in general discussion that wealth focused investors consider asset longevity, ownership structure, and time horizon when reviewing property data. This commentary is general in nature and does not consider individual financial situations.

Housing supply research from the Property Council of Australia continues to highlight long term structural shortages, which remain relevant for multi generational ownership thinking alongside demographic data published by the Australian Bureau of Statistics.

This article is intended to provide factual, general information based on publicly available Australian data and does not constitute financial or investment advice.